Expert Bookkeeping Services in Toronto

Key Highlights

- Discover the benefits of reliable bookkeeping services for maintaining accurate financial records.

- Understand the importance of clean financial statements for making smart business decisions.

- Explore how modern accounting software can streamline your financial processes.

- Find out how to choose the right partner to get expert advice tailored to your business needs.

- See how outsourcing can save you time and help you focus on growing your business.

Introduction

Running a business in Toronto is demanding, and managing your finances can quickly become overwhelming.

Are you struggling to keep up with your books while focusing on your customers?

This is where reliable bookkeeping services come in.

Partnering with professional accountants for your financial management ensures your records are accurate and up-to-date.

It gives you a clear picture of your company’s financial health, freeing you up to do what you do best: growing your business and serving your clients.

.png)

Comprehensive Bookkeeping Services Offered in Toronto

Finding the right support for your business finances is crucial. In Toronto, you can access a full array of services designed to fit your specific needs.

With years of experience, we help you set up a financial plan that makes sense, helping you organize your financial records using the latest accounting software.

Our goal is to give you a clear view of your finances, from daily transactions to comprehensive financial statements. Let’s explore the specific solutions that can help your business thrive.

Monthly and Quarterly Bookkeeping Solutions

Consistent financial tracking is the backbone of any successful business.

With monthly bookkeeping services, you receive a clear and accurate Income Statement and Balance Sheet regularly.

This process involves organizing all your transactions into categories, giving you an easy-to-understand overview of your earnings and expenses.

You'll know exactly where your money is coming from and where it's going.

This regular flow of financial data is vital for monitoring your company's health.

Instead of letting paperwork pile up, our team handles the data entry and reconciliation using modern accounting software.

This ensures your records are always current and precise, removing the burden from your shoulders.

Ultimately, these services provide you with the financial clarity needed to make informed decisions.

Whether you need reports monthly or quarterly, having organized financial information empowers you to manage your business more effectively and plan for future growth.

Payroll Processing for Local Businesses

Payroll is more than just paying your employees; it directly impacts your cash flow, workplace productivity, and overall business growth.

For Canadian businesses, navigating payroll can be complex. An inefficient system can lead to errors and compliance issues, affecting your ability to make sound business decisions.

At MaTax Inc., we understand the importance of a reliable payroll system.

We offer comprehensive payroll processing services to ensure your team is paid accurately and on time.

By handling this critical aspect of your financial management, we help you maintain a productive and positive work environment.

Our payroll services include:

- Timely and accurate payroll processing

- Ensuring compliance with government regulations

- Managing year-end government filings like T4s

Let us take care of your payroll so you can focus on your core operations.

Choosing the Right Bookkeeping Partner in Toronto

Selecting a bookkeeping partner is one of the most important decisions you'll make for your business.

You need a team with years of experience that you can trust to handle your sensitive financial information.

The right firm provides more than just number-crunching; it offers expert advice and reliable bookkeeping services that support your long-term goals.

Finding a partner who understands your vision is key.

The following sections will guide you on what to look for and how to evaluate potential firms for your needs.

Key Qualities to Look for in a Experience Bookkeeper

When you entrust your finances to someone, you need to be sure they are qualified and reliable.

A Experience bookkeeper should possess a strong set of core competencies and a proven track record.

At MaTax Inc., we pride ourselves on accuracy, promptness, and proficiency, which are all hallmarks of a great bookkeeper.

Here are some key qualities to look for:

- Accuracy: Meticulous attention to detail to ensure error-free financial records.

- Knowledge: A deep understanding of accounting principles and tax regulations.

- Reliability: Consistency in meeting deadlines and providing timely information.

- Communication: The ability to explain complex financial information in a clear, understandable way.

How to Evaluate Bookkeeping Firms for Your Needs

Every business is different, so finding a bookkeeping firm that understands your unique needs is essential.

Start by assessing the range of services they offer.

Do they provide basic bookkeeping, or can they offer more comprehensive financial solutions like tax planning and payroll?

The right firm will offer flexible services that can adapt as your business grows.

Next, consider their approach to client relationships. Look for a team that strives to build a solid, long-term partnership.

A firm that offers a free consultation, like we do at MaTax Inc., shows a commitment to understanding your business before you sign on.

This initial meeting is a great opportunity to ask questions and see if they are a good fit.

Finally, seek out expert advice and testimonials. What are other clients saying about their experience?

Positive reviews often highlight professionalism, reliability, and a willingness to go above and beyond.

Choosing a firm that provides reliable bookkeeping services is an investment in your company's future success.

Exploring the Costs of Bookkeeping Services in Toronto

Understanding the cost of professional bookkeeping is a common concern for business owners.

Bookkeeping fees in Toronto can vary widely depending on the complexity of your financial processes and the level of service you require.

Whether you're a startup or an established professional corporation, there's a solution that fits your budget.

It’s helpful to think of bookkeeping not as a cost, but as an investment in a streamlined accounting system that saves you money in the long run.

Let’s break down the factors that influence these fees.

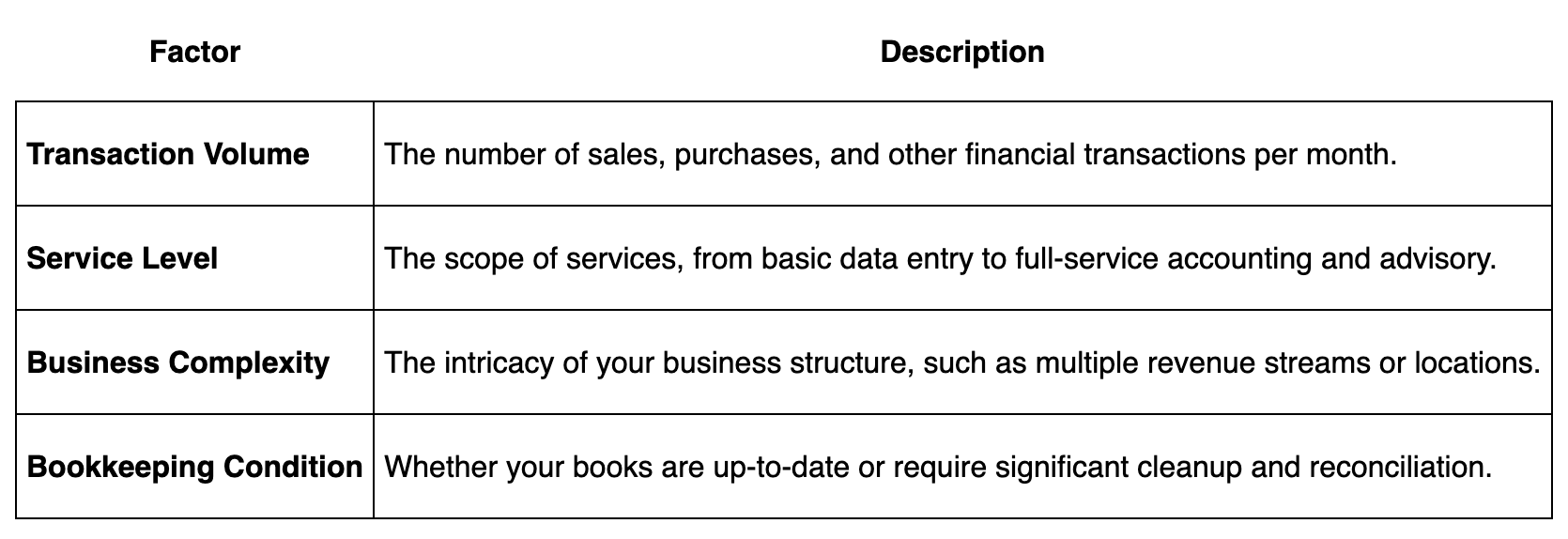

Factors That Affect Bookkeeping Fees

Several factors determine the bookkeeping fees for your business. The primary driver is the volume and complexity of your transactions.

A business with hundreds of monthly transactions will naturally require more time and effort than one with only a few.

The state of your current records also plays a role; cleaning up messy books will involve more initial work.

The level of service you need is another key factor.

Are you looking for basic data entry, or do you need comprehensive financial management, including financial statement preparation and expert advice?

Firms with years of experience and an advanced accounting system may offer tiered packages to suit different needs.

Here is a breakdown of common factors influencing bookkeeping fees:

Comparing Value Between Outsourced and In-house Bookkeeping

Deciding between hiring an in-house bookkeeper and outsourcing to a firm can be tough.

While an in-house employee offers immediate availability, outsourcing often provides greater value and expertise.

Outsourcing frees up your valuable time, allowing you to focus on your core competencies—the activities that generate revenue and grow your business.

Instead of getting bogged down in financial administration, you can dedicate your energy to serving customers and developing new products or services.

Reliable bookkeeping services handle the numbers so you don't have to.

Consider these key benefits of outsourcing:

- Cost Savings: Pay only for the services you need without the expense of a full-time employee.

- Access to Expertise: Leverage the knowledge of experienced professionals and CPAs.

- Scalability: Easily scale your bookkeeping services up or down as your business needs change.

Additional Services: Tax Filing and Financial Reporting

Many people wonder if bookkeeping services also handle taxes.

The answer is yes! A great bookkeeping firm does more than just record transactions; it provides a full suite of services, including tax filing and financial reporting.

Having accurate books throughout the year makes tax preparation much smoother.

With all your financial information organized, our team can help you prepare and file your tax returns accurately and on time, ensuring you meet all your obligations.

Let's look closer at how this support works.

Year-End Government Filings and Compliance Support

As the year ends, the pressure of government filings can be intense for business owners.

Meeting all your tax obligations is mandatory, and a single mistake can lead to penalties.

This is where professional compliance support becomes invaluable.

We ensure all your necessary documents, from T2 corporate income tax returns to other year-end reports, are filed correctly and on time.

Our team stays up-to-date with the latest changes in tax law to ensure your business remains compliant.

We help you navigate the complexities of your income tax responsibilities, providing peace of mind that everything is handled according to government regulations.

This support is crucial for avoiding costly errors and audits.

By managing your year-end filings, we help you close out the fiscal year smoothly.

This allows you to start the new year with confidence, knowing your tax obligations have been met and your financial house is in order.

Tax Preparation Services for Businesses and Nonprofits

Tax preparation can be a complicated process, whether you are running a small business or a nonprofit organization.

Our tax preparation services are designed to simplify this task for you.

We work to maximize your return and ensure you receive the best possible refund by identifying all eligible deductions and credits.

Our expertise extends to various types of entities, each with unique requirements.

For instance, preparing a corporation income tax return involves different rules than filing a personal income tax return.

We also have experience with the specific financial reporting needs of nonprofit organizations, helping them maintain their status and meet compliance standards.

We can assist with a range of tax services, including:

- Preparation of T2 corporation income tax returns

- Filing of T1 personal income tax returns for self-employed individuals

- Specialized tax services for nonprofit organizations

Let us handle your tax preparation with the accuracy and proficiency your organization deserves.

Benefits of Outsourcing Bookkeeping in Toronto

Why should you consider outsourcing your bookkeeping? For many Toronto business owners, the benefits are transformative.

Outsourcing gives you back valuable time, allowing you to focus on your primary business activities instead of getting stuck on administrative tasks.

It provides access to expert advice and robust financial solutions you might not have in-house.

Choosing reliable bookkeeping services means you're not just delegating tasks; you're gaining a strategic partner dedicated to your financial success. Let’s explore these advantages in more detail.

Increased Efficiency and Focus on Core Business

As a business owner, your time is your most valuable asset. Every hour spent on bookkeeping is an hour not spent on your core competencies the activities that drive growth and revenue.

Outsourcing your financial processes leads to a significant increase in efficiency, as it frees you and your team to concentrate on what you do best.

Imagine what you could accomplish with that extra time. You could focus on customer relationships, product development, or strategic planning.

By handing over your bookkeeping to a professional team, you can be confident that your financials are being managed accurately while you steer the business forward.

Key benefits of this approach include:

- More valuable time: Dedicate your hours to revenue-generating tasks.

- Reduced stress: Eliminate the worry of managing complex financial records.

- Improved focus: Concentrate on your business's strategic goals and core operations.

Access to Expertise and Latest Technology

When you outsource your bookkeeping, you gain immediate access to a team with professional expertise.

They bring years of experience to the table, offering insights and expert advice that can help you optimize your financial performance.

This is a level of knowledge that can be expensive and difficult to build in-house.

Furthermore, you benefit from the best technology without having to invest in it yourself.

Accounting firms are always up-to-date with the most efficient tools for bookkeeping, payroll, and tax preparation.

They leverage this technology to provide you with accurate and timely financial information.

This combination of human expertise and advanced software ensures your books are managed with precision.

You get the peace of mind that comes from knowing your finances are in capable hands, supported by the best tools available in the industry.

Bookkeeping Solutions for Diverse Toronto Sectors

Toronto is home to a vibrant and diverse business community, and each sector has its own unique needs when it comes to bookkeeping.

From startups and real estate investors to law firms and nonprofits, a one-size-fits-all approach doesn't work.

That’s why we offer sector-specific solutions tailored to your industry's accounting needs.

Finding a firm that provides reliable bookkeeping services with experience in your field is key.

Let's look at how these services are customized for different types of organizations.

Small Businesses and Startups

For small businesses and startups, establishing strong financial habits from day one is crucial for long-term success.

Managing cash flow, tracking expenses, and understanding profitability can be overwhelming when you're also trying to build a customer base and develop your product.

This is where tailored bookkeeping services make a huge difference.

Regular support, such as monthly bookkeeping, ensures your financial records are always accurate and organized.

This provides you with timely financial statements, like the Income Statement and Balance Sheet, which are essential tools for making strategic decisions.

Seeing a clear picture of your finances helps you identify trends, manage your budget, and plan for growth.

At MaTax Inc., we work closely with small and medium business owners to develop year-round strategies.

By taking over your bookkeeping, we allow you to focus on your customers and scale your operations with confidence, knowing your financials are in expert hands.

Services for Nonprofit Organizations

Nonprofit organizations have unique accounting needs that set them apart from for-profit businesses.

They must adhere to specific reporting standards to maintain their tax-exempt status and demonstrate accountability to donors, grantors, and the public.

Managing funds from different sources and tracking restricted versus unrestricted donations requires specialized knowledge.

A bookkeeping service experienced with nonprofit organizations can help you navigate these complexities.

They ensure your financial records are meticulously maintained to meet all compliance requirements.

This includes managing grant reporting, preparing for audits, and fulfilling all tax obligations accurately.

Our services for nonprofit organizations include:

- Proper tracking and allocation of funds

- Preparation of financial statements for board and donor review

- Assistance with year-end filings and compliance support

With professional support, you can ensure transparency and focus on your organization's mission.

.png)

Conclusion

In summary, expert bookkeeping services are essential for businesses in Toronto looking to enhance their operational efficiency and financial accuracy.

By opting for professional bookkeeping, you not only streamline financial processes but also gain access to valuable expertise that can lead to more informed decision-making.

Whether you are a small startup or a nonprofit organization, the right bookkeeping partner can significantly impact your business’s success, allowing you to focus on what truly matters growing your enterprise.

If you're ready to take the next step in optimizing your financial management, get in touch with us today!

Frequently Asked Questions

What distinguishes bookkeeping from accounting in Toronto?

Bookkeeping is the process of recording daily financial transactions, while accounting is the process of interpreting, analyzing, and summarizing that data.

Bookkeeping provides the organized financial records that professional accountants use to create financial statements and provide strategic advice on your overall financial processes.

Can bookkeeping services help improve my tax returns?

Absolutely. Accurate and organized financial records are the foundation of successful tax preparation.

Professional bookkeeping ensures all your income and expenses are correctly categorized, which helps maximize deductions and credits during tax filing. With expert advice, you can optimize your tax returns and avoid costly errors.

How is bookkeeping for Toronto businesses unique compared to other regions?

Bookkeeping for Toronto businesses involves specific compliance with provincial and federal regulations, like filing GST/HST returns.

Matax understands the unique needs of Canadian businesses, from navigating rules for a professional corporation to providing financial management advice tailored to the competitive Toronto market.