.png)

Tax Filing for New Immigrants in Canada: A Complete Guide

Key Highlights

- Your residency status is the key to determining your Canadian income tax obligations.

- You must file a tax return to access important government benefits and tax credits.

- A Social Insurance Number (SIN) is essential for filing your taxes and receiving benefits.

- You need to report your worldwide foreign income earned after you became a resident of Canada.

- The Canada Revenue Agency (CRA) is the government body that manages your tax return.

- Key deadlines are April 30 for most people and June 15 for the self-employed.

Introduction

Welcome to Canada! As a new immigrant, understanding how the Canadian tax system works is an important step in settling into your new life.

Even if you have little or no income, filing your taxes ensures you stay compliant with Canadian tax laws and gain access to valuable government benefits and credits.

This guide explains everything you need to know about filing your first tax return in Canada as a newcomer.

Understanding Tax Obligations for New Immigrants in Canada

As a newcomer, one of your key responsibilities is understanding your tax obligations. The Canada Revenue Agency (CRA) is the federal body that administers taxes.

In Canada, the tax year follows the calendar year, from January 1 to December 31. You are generally required to file a return if you owe taxes or if the CRA sends you a request to file.

Even if you don't owe any tax, filing a return is crucial. It’s the only way to claim a refund and receive valuable benefit and credit payments.

This section will break down who needs to file, how taxes work in your first year, and the role of the CRA.

Who Must File Taxes in Canada as a Newcomer

If you are considered a resident of Canada for tax purposes, you may need to file an income tax return.

You typically become a resident for tax purposes when you establish significant residential ties in Canada, such as having a home, a spouse, or dependents here. This often happens on the day you arrive in the country.

You must file a return if you have to pay tax for the year or if the CRA asks you to. But what if you don't have any income?

It's still highly recommended that you file. Filing a return is how you apply for benefits like the GST/HST credit and the Canada Child Benefit.

Your specific tax situation determines your requirements. Regardless of income, filing your return ensures you can get any refund you are owed and establishes your eligibility for government programs designed to help you and your family.

How Canadian Taxes Apply to Your First Year

Your first year in Canada presents a unique tax situation, especially if you arrived partway through the tax year.

For tax purposes, you are generally considered a resident from a specific date. You are required to report your worldwide income earned after that date.

For example, if you became a resident in July 2024, you would file your first Canadian income tax return for the 2024 tax year.

On this return, you would report all income you earned from both Canadian and foreign sources between July and December 31, 2024.

Income you earned before you arrived in Canada is not subject to Canadian tax. However, you still need to declare it on your return.

The government uses this information from the previous year to correctly calculate any tax credits and benefits you are eligible for.

The Role of the Canada Revenue Agency (CRA) for New Arrivals

The Canada Revenue Agency, or CRA, is the government body responsible for administering taxation in Canada.

As a new arrival, you will interact with the CRA when you file your taxes and apply for benefits. They process your return and ensure the tax laws are applied correctly.

After you file your tax return, the CRA will review it and send you a document called a Notice of Assessment (NOA).

This document is very important. It summarizes your tax information, shows if you have a refund or owe a balance, and confirms that your return has been processed.

You will need your NOA in the future to apply for loans or to set up your online CRA My Account.

Think of the CRA as your main point of contact for all federal tax matters.

They provide the forms, guides, and services you need to manage your taxation journey in Canada.

Determining Your Residency Status for Canadian Tax Purposes

Your residency status is the most important factor in determining your tax obligations in Canada.

For income tax purposes, your status decides what income you need to report and what credits you can claim.

Your residency is not the same as your immigration status; it is based on the residential ties you have with Canada.

Sometimes, a tax treaty between Canada and your home country can also affect how your residency status is determined.

Understanding your ties will help you file correctly. Below, we'll explore how to identify your tax residency and what each status means for you.

Identifying Your Tax Residency Type

To figure out your tax residency, the CRA looks at your residential ties to Canada.

If you establish significant ties, you are generally considered a Canadian resident for tax purposes. This status often begins on the day you arrive in Canada to live.

The CRA considers several factors as significant residential ties. The most important ones include:

- A home in Canada (owned or rented)

- A spouse or common-law partner in Canada

- Dependents (like children) in Canada

If you are unsure of the exact date you became a resident, you can fill out Form NR74, "Determination of Residency Status (Entering Canada)."

The CRA will review your information and provide an official opinion on your residency status, which gives you a clear date to use for your tax filing.

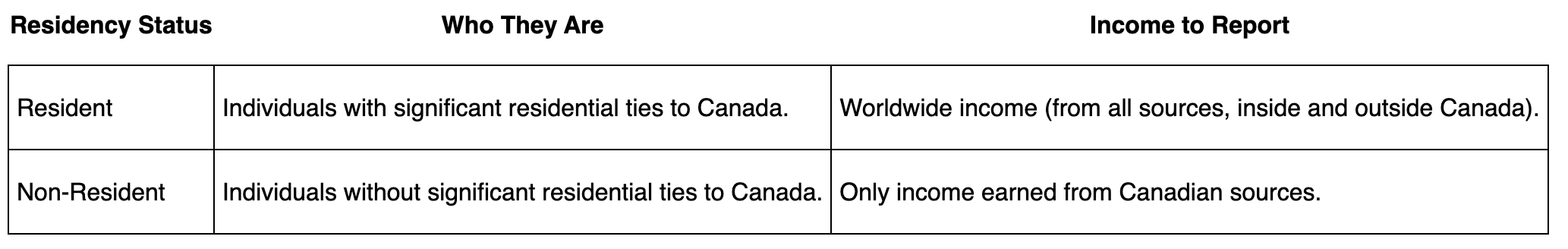

Differences Between Residents, Non-Residents, and Deemed Residents

Your tax obligations change depending on whether you are a resident, non-resident, or deemed resident of Canada.

A resident of Canada typically has significant residential ties, while a non-resident does not.

You might be a non-resident if you're a temporary visitor or student staying for less than 183 days.

Here is a simple breakdown of the main differences:

The tax situation for a deemed resident is more complex and can apply to individuals who stay in Canada for 183 days or more in a year but don't establish significant residential ties.

Because these rules can be complicated, getting professional advice is a great idea.

A tax expert can review your specific situation and ensure you file correctly.

Impact of Residency Status on Filing Requirements

Your residency status directly impacts how you complete your tax return. The determination of residency status is the first step in understanding what you need to report.

If you are a resident of Canada, even for part of the year, you must report your worldwide income earned during the period you were a resident.

This means if you moved to Canada in the middle of the year, your tax filing will reflect that.

You will report income from all sources earned after your date of arrival.

If you are a non-resident, your tax filing is simpler, as you only need to report income from Canadian sources, like employment or business income earned in Canada.

Ultimately, your residency status dictates the scope of your tax return. Getting this right ensures you pay the correct amount of tax and receive all the benefits you are entitled to.

If you are unsure, consulting with a tax professional can provide clarity and peace of mind.

Key Documents Needed to File Your First Canadian Tax Return

Getting your paperwork in order is a great way to make tax filing easier. To file your first Canadian tax return, you’ll need to gather several key documents.

These include personal identification like your Social Insurance Number, your immigration papers to confirm your date of entry, and all of your income records.

Having these documents ready will streamline the process, whether you file on your own or with a professional. Let’s look at the essential documents you’ll need, from your SIN to your income tax slips.

Social Insurance Number (SIN) and Temporary Tax Numbers

A Social Insurance Number (SIN) is essential for anyone wishing to work or access government benefits in Canada.

Newly arrived immigrants must obtain a SIN from Service Canada, as it plays a critical role in your income tax obligations.

For those without a SIN, a temporary tax number can be issued by the Canada Revenue Agency (CRA) for tax purposes, ensuring that your Canadian income tax return remains compliant.

Securing these identifiers is crucial for a seamless transition into the Canadian tax system.

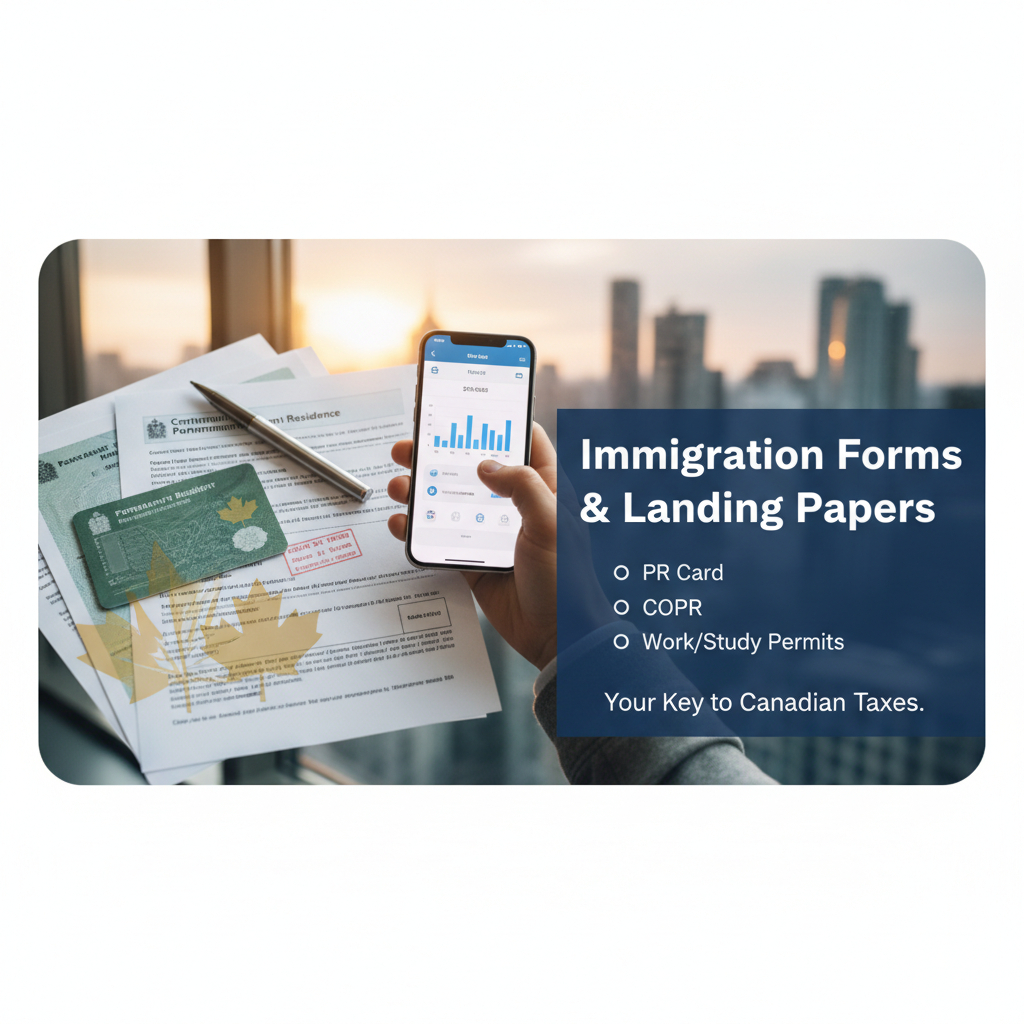

Immigration Forms and Landing Papers

Your immigration forms and landing papers are crucial when filing your first tax return.

These documents officially establish your date of entry into Canada, which is the date the CRA generally considers you a resident for tax purposes.

This date determines the period for which you need to report your worldwide income.

Keep these documents safe and accessible. The information on them helps verify your identity and your residency status. Key immigration documents include:

- Permanent Resident Card (PR Card)

- Confirmation of Permanent Residence (COPR)

- Work permits or study permits

Having this information on hand is essential for accurately completing your return.

It provides the CRA with the necessary proof of your arrival and helps ensure your tax assessment is correct from your very first filing.

Employment and Income Records for Canadian and Foreign Earnings

To file your taxes, you must report all sources of income earned after you became a resident.

This includes both Canadian income and foreign income.

If you were employed in Canada, your employer will provide you with a T4 slip by the end of February, which details your employment income and deductions.

You may receive other types of income slips, known as tax slips, depending on your financial activities. These can include:

- T5 slip for investment income

- T3 slip for income from a trust

- T2202 for tuition and education expenses

Remember to also gather records of any foreign income you earned after your arrival.

This could be from a job, a business, or investments outside of Canada. Having clear records for every type of income is necessary for an accurate tax return.

Preparing to Report Foreign Income as a Newcomer

Canada's tax system requires residents to report their worldwide income.

This means any foreign income you earned after becoming a resident must be included on your Canadian income tax return.

This might be a new concept, but it is a fundamental part of filing taxes in Canada for income tax purposes.

Reporting foreign earnings and assets correctly is essential to stay compliant.

The following sections will explain what counts as foreign income, how to declare overseas assets, and what you need to know about currency conversion.

What Counts as Foreign Income

When you file your Canadian tax return as a resident, you must report all foreign income earned after your date of arrival.

This ensures that all sources of income are accounted for. So, what exactly is considered foreign income?

It includes a wide variety of earnings from outside Canada. Common examples of this type of income are:

- Employment income from a job in another country

- Income from a foreign business

- Investment income, such as interest, dividends, or capital gains from foreign sources

In some cases, a tax treaty between Canada and another country may mean that certain income is exempt from Canadian tax.

However, you still must report the income on your return and then claim a deduction for the exempt portion.

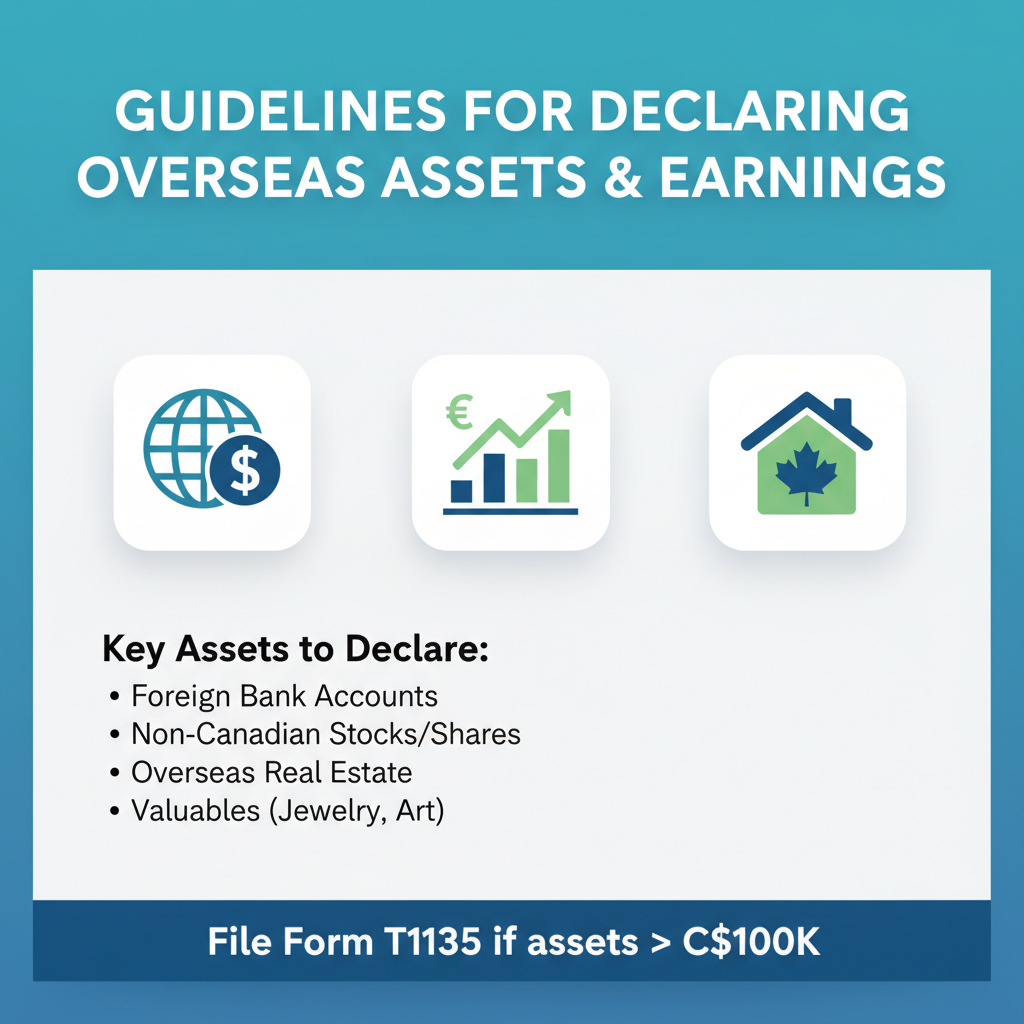

Guidelines for Declaring Overseas Assets and Earnings

In addition to reporting foreign income, you may also need to declare your overseas assets.

If the total value of your foreign assets was more than CA$100,000 at any point during the year, you must file Form T1135, Foreign Income Verification Statement, with your income tax return.

This rule applies to assets like:

- Foreign bank accounts

- Stocks and shares of non-Canadian companies

- Real estate located outside of Canada

It's also important to establish the fair market value of any property you owned, such as jewelry, art, or shares, on the date you became a Canadian resident.

This value will be your cost basis for calculating any capital gains or losses if you sell the property in the future.

Keeping a record of this market value is essential for your future Canadian tax return.

When and How to Convert Foreign Currency Amounts

All income and asset values reported on your Canadian income tax return must be in Canadian dollars.

This means you will need to perform a currency conversion for any foreign income or the market value of foreign assets you report.

When converting, you should use the exchange rate that was in effect on the day the transaction occurred.

For simplicity, the Bank of Canada publishes official exchange rates that you can use.

You can use an average annual rate if the income was received throughout the year.

The key steps for converting foreign currency are:

- Identify the amount of foreign income in its original currency.

- Find the correct Bank of Canada exchange rate for the relevant day or year.

- Calculate the equivalent amount in Canadian dollars and report it on your return. This ensures your foreign income is reported accurately.

Step-by-Step Guide to Filing Your First Tax Return in Canada

Filing your first tax return in Canada can be broken down into a few manageable steps.

The process involves gathering your documents, choosing a filing method, and submitting your return to the CRA.

You can use certified tax software, mail a paper income tax package, or get help from a tax clinic or a professional.

This section provides a clear, step-by-step guide to help you navigate the process.

From creating your CRA account to meeting important deadlines, we'll cover everything you need to know to complete your first tax return successfully.

Creating a CRA My Account for New Immigrants

You cannot create a CRA My Account until after you file your taxes for the first time.

Once the Canada Revenue Agency processes your first return and issues your Notice of Assessment (NOA), you can register for an account.

This secure online portal is a valuable tool for managing your tax situation.

With a CRA account, you can:

- Track your refund or balance owing

- View your NOA and other tax documents

- Manage your benefit and credit information

To register, you will need your Social Insurance Number, date of birth, postal code, and information from your most recently filed tax return.

Setting up your CRA My Account is a great step to take after your first filing, as it makes managing your tax affairs much easier in the years to come.

Choosing to File Electronically or by Paper

As a newcomer, you have a choice between electronic filing and paper filing for your first return.

Many people find electronic filing to be faster and more convenient. One popular method is NETFILE, which allows you to submit your return online using certified tax software.

However, there can be restrictions for first-time filers. For example, you may only be able to use NETFILE if you have a SIN that starts with a "9". The alternative is to file a paper return.

You can download the income tax package from the CRA website or request a copy by mail.

Here are your main options:

- EFILE: A tax professional files your return electronically for you.

- NETFILE: You file online yourself using certified software.

- Mail: You send a completed paper return to the CRA. If electronic filing seems complicated for your first time, the tax experts at MA Tax Inc. can manage the entire process for you using EFILE.

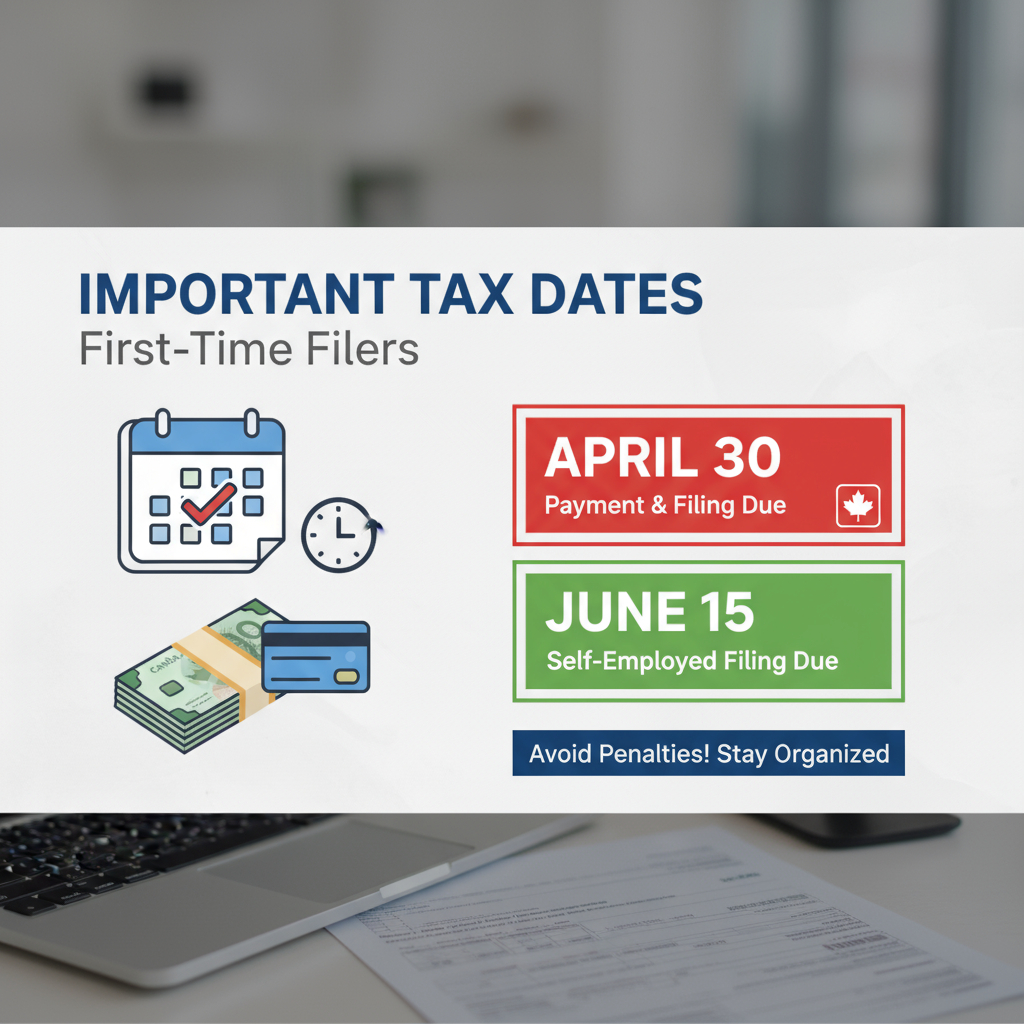

Important Deadlines and Payment Dates for First-Time Filers

Meeting the tax filing deadline is crucial to avoid penalties and interest on any taxes you owe.

For most individuals, the deadline to file your tax return for the previous calendar year is April 30.

For instance, your 2024 tax return is due by April 30, 2025.

If you or your spouse are self-employed, you have a later tax filing deadline of June 15.

However, even if you are self-employed, any tax payment you owe is still due by the April 30 deadline.

It's important to separate these two dates in your mind.

If the deadline falls on a weekend or public holiday, the CRA considers your return on time if they receive it or it is postmarked by the next business day.

Keeping track of these payment dates and deadlines will help you stay on the right side of the CRA.

Tax Credits and Benefits Available to New Immigrants

One of the biggest incentives for filing your taxes is to access the many tax credits and government benefits available to residents of Canada.

After the CRA processes your return and sends your Notice of Assessment, you can begin receiving payments for programs designed to help with the cost of living, like the Harmonized Sales Tax (HST) credit.

These programs can provide significant financial support to you and your family.

Let's explore some of the key federal and provincial programs, as well as common deductions you may be able to claim.

Government Programs: GST/HST Credit, Canada Child Benefit

By filing a tax return, you automatically apply for several key government programs.

These are not just for citizens; new immigrants are often eligible as well.

These programs provide regular, tax-free credit payments to help with living expenses.

Some of the most important programs include:

- GST/HST Credit: A quarterly payment to help individuals and families with low to modest incomes offset the goods and services tax/harmonized sales tax they pay.

- Canada Child Benefit (CCB): A monthly payment to help eligible families with the costs of raising children under 18.

You may also be eligible for provincial or territorial benefit programs. Filing your taxes is the only way to access these valuable benefits.

Claiming Deductions Unique to New Canadians

In addition to credits, you can also lower the amount of tax you have to pay by claiming deductions.

While there aren't deductions available only to new Canadians, you are able to claim the same ones as other residents, which can significantly reduce your taxable income.

Make sure to keep receipts for any eligible expenses you incur. Some common deductions you might be able to claim include:

- Childcare expenses

- Medical expenses not covered by insurance

- Contributions to a Registered Retirement Savings Plan (RRSP)

If you are running a small business or are self-employed, you can also deduct eligible business expenses.

Understanding which deductions you qualify for can be complex, but it can save you a lot of money.

Working with a tax professional can help you identify every deduction you're entitled to claim.

Conclusion

In conclusion, understanding tax filing as a new immigrant in Canada is crucial for ensuring compliance and maximizing your potential benefits.

By familiarizing yourself with tax obligations, residency status, and the necessary documents, you can navigate your first tax return smoothly.

Additionally, taking advantage of available tax credits and benefits can significantly enhance your financial situation during this transition period.

Remember, you don't have to face this process alone.

If you have questions or need assistance, get in touch with our team at MA Tax Inc.

We offer tailored services to help you maximize your tax return while providing valuable insights for newcomers.

Let us support you on your journey to settling into your new life in Canada!